Key takeaways:

- Infor made an early commitment to multi-tenant cloud with their industry-focused CloudSuite strategy.

- With judicious acquisitions like GT-Nexus (now Infor Nexus) and Birst, and internal developments like Coleman, Infor is ready to move to third-generation “Intelligent CloudSuites.”

- Infor is innovating across the board, applying analytics and AI in their products, for implementation, and to support on-going use to help customers optimize business outcomes.

CIMdata had the pleasure of attending Inforum 2019 held in New Orleans, LA on 23-26 September. Infor held an Analyst Event on September 23rd leading into the main conference sessions through September 26. CIMdata attended the analyst event and a few main tent sessions upon which this commentary is based.

Travel and/or other expenses were provided by Infor.

Changes at the Top

CIMdata attended the Infor Innovation Summit in June 2019, which provided an excellent update on Infor, their strategy, and offerings. 1 One would think that not much could change in a few short months. But the only constant is change, as some have said, and Infor saw big changes in the executive suite in August. 2 Mr. Charles Philips, the former CEO, is now Chairman of the Board, and Kevin Samuelson, a 14-year Infor veteran of M&A and CFO roles, was named CEO, a big transition, as Mr. Philips led Infor in a time of great change and significant growth. Mr. Samuelson clearly helped architect some of this success in his M&A and finance roles. He is well positioned to take over company leadership. The same press release listed new expanded roles for other company veterans. Mr. Soma Somasundaram, the CTO, also now fills a newly created President of Products position.

The other change was in the way that Infor’s executives and their lead investor, Koch Equity Development (KED), spoke about a potential initial public offering. Over the last two years, public statements by the company talked of an IPO in the near future. As recently as January 2019 a press release announcing a $1.5 billion infusion from KED was titled “Infor Announces $1.5 Billion Investment Ahead of Potential IPO” that suggested an IPO in 2019 or 2020. 3 When asked a question about the IPO at the Analyst Event the timeline seemed to have stretched, with no target in mind. They emphasized that Golden Gate Capital has been with Infor since 2002, so they have been in it for the long term, as KED certainly is based on their comments at Inforum 2019 and previous events. This should have no practical impact on Infor’s customer base as their current investors seem more than willing to keep the investment taps open as need be.

Third Generation “Intelligent” CloudSuites

Infor is a significant player in the enterprise software market, with FY2019 revenues of $3.2 billion. Enterprise Resource Planning (ERP) offerings have been at the core of Infor’s business just as they are at the core of businesses that adopt them across a wide range of industries. Companies need to buy things, make things, hire people, do their books, deal with customers and suppliers, and a range of other functions, and ERP solutions have evolved to provide many of these functions in one system. In his remarks at the Analyst Event, Mr. Somasundaram described ERP as an expansive solution whose boundaries have blurred. He asked: “Can one monolithic ERP system meet the needs of a wide range of industries?” Infor clearly believes the answer is no, and put industry-centricity at the core of their product strategy. They built their CloudSuites around their strongest ERP solutions, each focused on different industry segments. Infor claims to have spent over $3 billion in R&D in recent years to rewrite these core applications as multi-tenant cloud offerings. They believe this approach will help them drive industry-specific functionality more quickly. The core is supplemented by the Infor Operating Service (OS) layer. It includes shared services like user experience (UX), security, integration, data management, and localization services. For example, Infor Ming.le provides a common UX, with their in-house design studio Hook & Loop continually enhancing the UX across the Web and mobile. The Infor OS also includes optional shared capabilities like data management, Coleman, application development functionality, and intelligent applications. These integrated, focused applications appropriate to a target industry are part of this Infor OS level. For example, one important optional solution is Infor Nexus, their global supply chain network. Mr. Andrew Kinder, Infor Vice President for Industry and Solution Strategy, cited the following statistics: connecting 65,000+ businesses and 36,000+ suppliers and factories, with 40+ financial institutions, 15,000+ carriers, and the top 80% of third-party logistics businesses results in $1 trillion in trade and processing over $50 billion in global payments. Many companies are turning to these commerce networks to enable more dynamism in their value chains. Infor is well positioned to support that trend. Recent CIMdata commentaries offer more detail on Infor’s approach.

Data may not be the new oil, but companies are looking for answers in data from their enterprise and beyond. In 2017, Infor acquired Birst, a provider of cloud-native business intelligence (BI), analytics, and data visualization capabilities to help organizations mine their data. 4 During that same year, Infor announced Coleman, which they described as “an enterprise-grade, industry-specific AI platform for Infor CloudSuite™ applications. 5 Infor’s data lake embraces open standards, making it easier in add external data to Infor’s own, giving Birst and Coleman more data to ingest for business benefit. At Inforum, Infor announced Artificial Intelligence (AI) as a Service, built on Coleman.6 The service offers a wide range of APIs to tap into the data lake. The press release included an example from Flint Hills Resources who plans to use Coleman with Infor Enterprise Asset Management (EAM) to get better insights on their asset health to help them transform the way they do maintenance. This is a good example because it illustrates how elements of the Infor stack can work in conjunction to support new use cases that enhance business outcomes.

A presentation entitled “Infor OS and Coleman Update” drove that point home. Mr. Massimo Capoccia, Infor Senior Vice President for Technology, and Mr. Rick Rider, Infor Senior Director of Product Management for Infor OS and Coleman, began their remarks with key process indicators for the Infor OS, e.g., over 18 billion data lake objects and 600 million API calls supporting 1.6 billion business events at about 10,000 customers served by 8 different Amazon Web Services (AWS) zones. They described three phases of Infor OS evolution. Their initial release was dubbed the CloudSuite “Conception” phase, where they first offered industry-focused CloudSuites. The addition of Infor ION, expanded APIs, mobile access, their data lake, and early digital assistants moved them to the CloudSuite “Productivity” phase. Now, with Coleman and other technologies enabling robotic process automation (RPA), more AI applications, and AI built into Infor Accelerators, their rapid implementation methodology, Infor is firmly in the CloudSuite “intelligent” era.

During his Analyst event remarks, Mr. Cormac Watters, General Manager, Head of International Markets for Infor, provided more detail on their vision for Infor Accelerators 4.0. Mr. Watters pre-announced Infor Process Intelligence, which will look at how processes are actually executed in Infor’s solutions for comparison with industry benchmarks. Infor is partnering with Signavio, a global leader in web-based business process modeling and intelligence tools, to deliver this new capability. 7 This will help Infor’s customers more readily adopt industry best practices during implementation, and will also be used to monitor Infor’s implementation process to support continuous improvement in service delivery. According to Mr. Watters, they are rebuilding their entire implementation methodology, looking for areas of improvement and opportunities to bring tools and science to bear. Like other software providers, Infor plans to leverage Agile methodologies to achieve a more rapid time to value.

Expanding Infor’s Go-to-Market Capacity

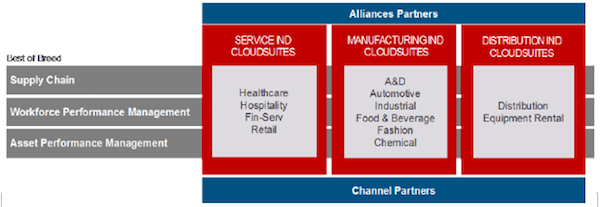

Infor has also invested significantly in building their global routes to market (GTM). Mr. Andrew Kinder, Infor Vice President for Industry and Solution Strategy, provided a great overview at the Industry Analyst event. Mr. Kinder stated that Infor has invested heavily in this area over the last several years. Their products are designed to go to market by industry. While that may sound straightforward, Mr. Kinder emphasized that Infor’s GTM had to also vary by region because their industry opportunities vary widely by region. For example, while Infor claims market leadership in healthcare in North America, they have not translated that success to Europe. That said, they also have some “best of breed” candidates that could be the tip of the spear to enter accounts, like supply chain, workforce performance management, and asset performance management. This will be supported by their Alliances Partners and Channel Partners, as shown in Figure 1. They currently have about 2,000 Channel Partners with about 1,000 sales reps. According to Mr. Kinder, they currently have about 1,700 opportunities with Alliance Partners. They are also adding boots on the ground. For example, Mr. Watters stated they Infor trained over 1,000 non-Infor consultants in the last six months. Access to skilled, experienced implementation resources is the limiting factor in technology adoption, an issue facing PLM for decades.

Beyond just sales, Mr. Kinder described how Infor is co-innovating with some of their leading Alliance Partners. Examples cited included work on the digital plant and the workforce of the future with Accenture and HCL on construction and “field service 4.0.” This is a good sign because system integrators do not make this type of investment if they do not see a payoff down the line.

Figure 1—Infor’s Routes to Market (Courtesy of Infor)

In the Tuesday general session, Mr. Watters and Mr. Rod Johnson, Infor General Manager Americas, laid out the various paths to Intelligent CloudSuites. They both agreed that getting your “Core-to-the-Cloud” was the most daunting path. Adopters like Flint Hills Resources used that approach—the age and complexity of their legacy application almost dictated it—and they think they got there 50% faster by biting that bullet. Going from the “Edge-to-the-Cloud” allows Infor to lead with their “world-class” offerings, like EAM, Infor Nexus, and PLM, stated Mr. Johnson. This approach is also suggested in Figure 1. Finally, they also see AI as an entry point in “AI-to-the-Cloud.” Fill Infor’s data lake with your enterprise data and apply Coleman and analytics to bring rapid time to value.

No matter the path, Infor will rely on Agile deployment methods to move from a “big bang” to multiple sprints. Using this approach, they expect the first working prototypes to be available in 3 months. To properly set expectations, they claim they will never change a “go live” date. If there is an issue, the delivery will be de-scoped. This can be tricky if an important function drops out of a given release but, as with much in organizational change management, setting the right expectation is half the battle in maintaining trust and organizational momentum. Mr. Johnson and Mr. Watters believe that companies will quickly get used to having multiple “go lives” making such changes routine. Infor Process Intelligence will help them learn more deeply with every implementation, improving the success of their customers overall.

Based on their comments, Infor believes that they can deliver 60% of desired functionality out-of-the-box (OOTB), with another 30% through “fine-tuning”. Their industry focus could make these numbers more feasible than for other solutions. The last 10% is left for “extensions” that will be supported by “Infor OS extensibility.” Enterprise software implementations have always suffered from too much customization, which is expensive and time-consuming to do, and then can lock an organization into old technology by making upgrades very difficult. Cloud is supposed to begin a new era, where companies will have to take OOTB because customization may not even be possible. Enabling “fine-tuning” and “extensions” using capabilities in the Infor technology stack is important because it allows customers to have it their way to the greatest extent possible. Infor claimed that some recent customers are seeing 50% reduction in deployment times. At the close of their session, Mr. Johnson and Mr. Watters mentioned the stretch goal facing their teams: pushing Infor to do it twice as fast at half the cost. That is something their customers would certainly endorse.

Conclusion

Inforum 2019 is an expansive event with a lively exhibit hall, The Hub, and many parallel sessions. This is as you would expect for an enterprise solution provider with a broad and deep portfolio. Infor pushed faster into the cloud than some others, committing to redesigning their solutions for multi-tenant cloud and using them to power their CloudSuite strategy. They have expanded their portfolio with key acquisitions like GT-Nexus (since rebranded as Infor Nexus) and Birst, and built some innovative solutions like Coleman to support their third generation Intelligent CloudSuites. Infor has also invested significantly in their GTM apparatus, including co-innovating with leading Alliance Partners like Accenture and HCL on new capabilities.

This is important because the enterprise software market is in a time of change that could provide significant opportunities for Infor. The move to the cloud in general is causing industrial firms to rethink their IT landscape, providing an opportunity. SAP introduced a step function into the product roadmap with HANA, their in-memory database. Companies will have to move to HANA and some may be rethinking their commitment to SAP. Oracle is trying to balance their Software-as-a-Service business (SaaS) with their role as a cloud infrastructure provider. This uncertainty may also induce some customers to consider a new provider.

Infor will need to be ready. If done well, Agile methodologies should make the implementation process more efficient, increasing throughput potential and reducing stress in their customers. But they will still need to have access to more sales and implementation resources, another area of investment for both Infor and their partners.

While doing all this with a new management team might seem risky on the surface, the fact that Infor filled the positions from within bodes well for maintaining focus. Many on their team were the architects of their business and technical success. It was this team that made the bet on the cloud and it appears Infor is ready to cash in.

1 CIMdata’s commentary on the event can be found here:

https://www.cimdata.com/en/resources/complimentary-reports-research/commentaries/item/12223-designed-for-progress-2019-infor-innovation-summit-commentary

This commentary has background and graphics that provide more background on what is covered here.

2 https://www.infor.com/news/infor-announces-executive-leadership-transition

3 https://www.infor.com/news/infor-announces-koch-investment

4 https://www.infor.com/news/infor-to-acquire-birst-infor

5 https://www.infor.com/news/infor-announces-coleman-ai-platform

6 https://www.infor.com/en-sg/news/infor-delivers-coleman-ai-platform

7 https://www.infor.com/news/infor-and-signavio-announce-strategic-partnership