Key takeaways:

- China's PLM market continues to rapidly expand, exceeding US$2.35 billion in 2018, up 16.2% from 2017. While the global PLM market grew by 9.4% and reached US$47.8 billion in 2018, China's PLM market share increased at an even faster rate, from 4.6% in 2017 to 4.9% in 2018.

- World-class manufacturers require accurate, traceable product information to meet innovation, as well as efficiency requirements.

- The JWI Platform, developed in China, is based on a modern microservice architecture, runs on-premise and in the cloud, while supporting real-time app-based solutions across extended enterprises.

- JWI’s vision to competing globally requires state of the art software development and business practices that are good for the local market, as well as for the global market.

The roots of PLM can be traced back to the support of product development and manufacturing. Efficient bills of material generation, subtractive machining processes, and accuracy were early objectives. Modern objectives of multinational manufacturers focus on improving the front end of the lifecycle with tools like Model-Based Systems Engineering (MBSE), Simulation & Analysis, and capturing profitable aftersales revenue by managing the as-maintained lifecycle state. Market and mindshare leaders in PLM from the United States and Europe are investing heavily in ensuring their platforms meet the extended lifecycle requirements of their customers.

While capable and proven, many of today’s leading PLM solution providers have complex software systems built using architectures designed for on-premise deployments, often including rather complex technical baggage within legacy code. The forward-thinking ones are migrating their platforms to be more service-oriented and leveraging microservices to take advantage of cost and performance potential of cloud native services.

At the same time, a new generation of cloud native solutions are being built by some solution providers on raw cloud platforms such as Microsoft Azure, AWS, and Alibaba, or application focused clouds such as Force.com or Forge.com. Most of the new generation of cloud platforms are focused on the design portion of the lifecycle. They support parts, EBOM, change management, and ERP integration, a high value, very visible portion of the lifecycle. The typical customer is a high-tech electronics firm that outsources manufacturing, most often to China. As the new generation matures, CIMdata expects them to add manufacturing capabilities, improved CAD integration, and aftersales support.

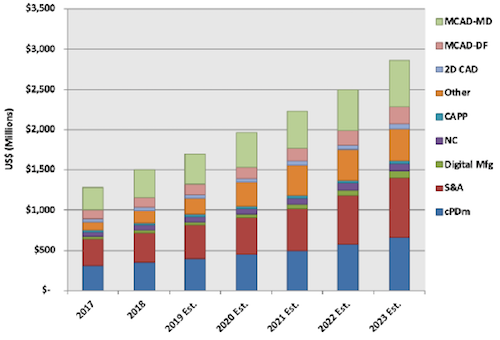

As Chinese companies advance in maturity from pure manufacturing and make-to-print operations, they are taking on higher value activities including change management and product design, and in a few cases marketing their brands globally. ERP was the only solution required for contract manufacturing, but CIMdata now sees a rapidly growing market for PLM in China to support the move up the valuer chain. Figure 1 shows the expected growth for the mainstream PLM market segments through 2023.

China’s PLM market exceeded US$2.35 billion in 2018, up 16.2% from 2017. The global PLM market grew by 9.4% and reached US$47.8 billion in 2018, while China’s PLM market share increased from 4.6% in 2017 to 4.9% in 2018.

With the advancement of the smart manufacturing strategy and the development of the industrial software market, the growth of the Chinese PLM market in 2019 is projected to be 14%, led by EDA, which is growing even faster than other segments. While the global market leaders have a head start in revenue capture, China has a vibrant startup culture that is producing solutions used in the local market and CIMdata expects they will mature to compete globally.

As part of CIMdata’s research we keep track of emerging PLM market participants including service and solution providers. We recently reviewed a new solution from a leading Chinese implementor that released a new product innovation platform, an area of significant interest and focus to CIMdata.

Introducing JWI

JWI was founded in 2007 and is based in Shenzhen, China’s innovation hub. JWI has a long history implementing PLM solutions and has been one of the largest implementers of PLM solutions in China.1 They developed their platform to overcome issues they faced every day while implementing other solution providers’ PLM solutions. Mr. Per Johnsson, founder and CEO of JWI, spent many years working for PLM mindshare leaders in China, and has used his knowledge of PLM and the Chinese market to create a new solution. The JWI PLM Platform was designed to meet the needs of local Chinese companies as well as architected to meet the requirements of multinational innovators.

The JWI PLM Platform

Product innovation platforms2 are the best-in-class approach to support sustainable PLM. Predicting business needs more than a few years out is difficult, so the best approach is to have a flexible solution that can adapt to unforeseen needs. While there are many important elements in a platform architecture, Gartner recently published3 three technology critical enablers, mesh app and service architecture (MASA), an API platform, and event processing that should be supported for long-term sustainability. CIMdata agrees that these capabilities are important and must be addressed for long-term platform sustainability, and the JWI PLM Platform includes these capabilities within its core.

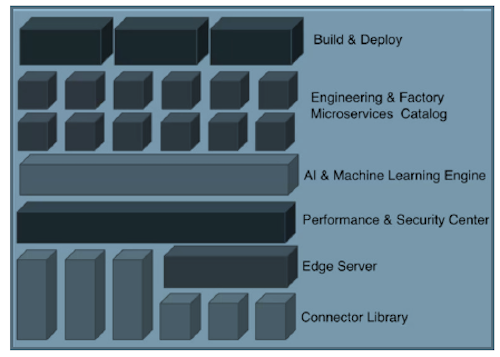

Figure 2—JWI Cloud Platform (Courtesy of JWI)

In reviewing the JWI PLM Platform architecture, shown in Figure 2, CIMdata sees a state-of-the-art architecture strategy that supports performance and security and uses Artificial Intelligence (AI) and machine learning (ML) at its core. This is a key advantage for the future as AI and ML are built in rather than pasted on. JWI demonstrates how the AI capability connects a product digital thread through inferred relationships rather than explicit data modeling, something we have not seen elsewhere.

JWI is especially proud of their real-time event processing built into the core of their platform. This was done to facilitate Industrial Internet of Things (IIoT) support. The benefit is that it enables efficient closed-loop processes from production back to the innovation processes. Incorporating IIoT as native services on the platform is a major strength.

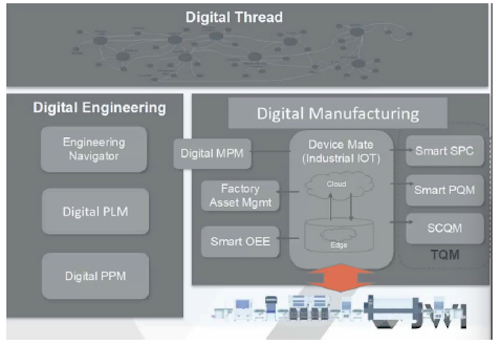

Figure 3—JWI Applications (Courtesy of JWI)

From an application perspective, JWI uses a microservice architecture to support both engineering and manufacturing as shown in Figure 3, an important requirement for the Chinese market. JWI’s Digital Engineering solution is focused on capturing design parameters that allow evaluation of design for manufacturing (DFM) to optimize the product design to support the manufacturing portion of the digital thread. This should help them achieve early success and generate revenue to help fund the development of a complete end-to-end digital thread/digital twin solution.

The microservice catalog is a clever approach to facilitating app development and is architected to support engineering and manufacturing. Since support of production is critical in China, the digital thread support starts with microservices to interrogate, view, and consume a product design. Digital Manufacturing Process Management (MPM) is able to transform an engineering BOM into manufacturing process plans that can be consumed by digital factory models. A viewer service is incorporated into the digital engineering solution. CIMdata views MASA, and especially the microservice approach, as a sustainable way to build out a product innovation platform. We look forward to seeing how JWI extends the platform to fully support Digital Engineering requirements.

From an IT perspective, JWI uses a modern open cloud stack including Docker and Kubernetes in a DevOps environment. Deployments can be on premise, in the cloud, or a hybrid mixture of both. Graphical tools are used to create workflows, model data, and assemble services into apps from the microservice catalog. Larger organizations often assemble their own apps, while smaller customers configure the out-of-the-box solutions. The microservice architecture employed by JWI enables easier deployment, upgrade, and improvements for both types of customers and all deployment types. CIMdata believes strongly in the low code approach to configuring solutions and is impressed with the catalog approach to present services to developers. Figure 4 shows JWI’s implementation of a production line digital twin. The definition of the factory is managed and the Device Mate module (i.e., JWI’s IoT solution) brings production data into the digital model in real time demonstrating an approach to smart manufacturing. JWI’s digital thread support for high-tech electronics manufacturers is extensive and supports surface mount technology, surface mount devices SMT/SMD, as well as injection molding and sheet metal processes.

Figure 4—Production Line Digital Twin (Courtesy of JWI)

Mr. Johnsson stated that he believes “the real-time capabilities of our solution made possible by the architecture improve insights and enable faster more accurate decisions.” CIMdata concurs and believes that improving the speed and quality of information within feedback loops will help any company’s digital transformation. Furthermore, we look forward seeing how the Digital Engineering area of the platform develops. The real-time integration with the factory and AI capabilities will likely produce some interesting capabilities.

Conclusion

Many high-tech electronics are manufactured in China and the sophistication of production lines has grown dramatically to meet market expectations. Chinese production facilities can be as complex and capable as any in the world. As complexity grows, PLM is being adopted, CIMdata has seen this play out over and over in the past three decades.

According to our measurements, the Chinese mainstream PLM market is currently over US$1.5 billion growing over 15% per year and should approach US$3 Billion by 2023. This market growth shows that the need for PLM is there, as well as the opportunity for local solution providers. The PLM platform launched by JWI this year has the capabilities needed to support local Chinese requirements and is architected to provide the support multinational manufacturers require as well. CIMdata is impressed by the JWI platform’s real-time microservice based architecture and the apps that have been released to the market. It is a great start and we look forward to tracking JWI’s growth.

For Chinese and Asian companies looking for a PLM solution, JWI should be on their short list. For global companies with operations in China or Asia, pay attention to JWI, as it may fit your needs today or likely will in the future. PLM mindshare leaders should also pay attention to competition from the east!

1 Research for this commentary was partially supported by JWI.

2 https://www.cimdata.com/en/resources/about-plm/a-cimdata-dossier-plm-platformization

3 https://www.gartner.com/en/documents/3970797/top-3-trends-in-application-architecture-that-enable-dig