Key takeaways:

- Dassault Systèmes’ strengths in their traditional industries has enabled them to build a new strength in life sciences.

- Medidata is well positioned to benefit from an increased demand for field trials of new drugs, treatments, and equipment to battle the COVID-19 pandemic.

- The Power’By strategy is helping Dassault Systèmes win multi-CAD clients in a range of industries.

- A focus on asset management and maintenance, repair, and overhaul (MRO) will help Dassault Systèmes better serve clients seeking to support product-as-a-service business strategies.

On June 10 and 11, 2020, CIMdata attended Dassault Systèmes’ first virtual Analyst Event. There was one four-hour block each day with sessions mostly focused on how Dassault Systèmes serves their key industry segments.

Dassault Systèmes’ top executives led off the event and set the strategic and financial context for the two days. Mr. Bernard Charlès’, Vice-Chairman and CEO of Dassault Systèmes, remarks bore the title “From Things to Life.” Dassault Systèmes has always been a company that likes to think big and develop stretch longer-term plans. According to Mr. Charles, the company recently plotted their course from 2020 to 2030.

Dassault Systèmes’ offerings for the Industry Renaissance, their phrase for the Industry 4.0/smart manufacturing trend which is having broad impacts on discrete manufacturing, are crafted by industry, a powerful organizing force for the company since 2008. They focus on 11 industries, encompassing 61 industry segments in total. Their portfolio is delivered using the 3DEXPERIENCE platform, their business innovation platform. Mr. Charlès revisited the announcement of the 3DEXPERIENCE platform back in 2012, highlighting some of the key values cited at the time: enabling stakeholder participation in innovation; helping industry leaders create consumer experiences; and enabling holistic 3D experiences that harmonize products, nature, and life. To make this last statement a reality, Dassault Systèmes has been heavily investing in supporting the life sciences, including a $750 million investment to acquire Accelrys in 2014 and most recently spending $5.8B to acquire Medidata.

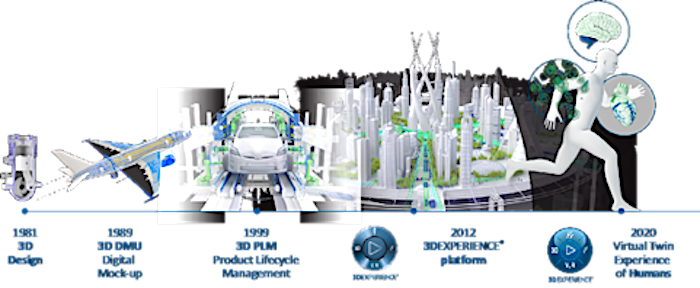

Mr. Charlès believes that life sciences and healthcare are due for their own Industrial Renaissance and Dassault Systèmes wants to lead the way. With Medidata they are well positioned, with a global leadership position in field trial management and a rapidly growing subscription base (85% of revenues). Dassault Systèmes rightfully believes they can bring some of the learnings and technologies from discrete manufacturing to help transform the life sciences. They see their “virtual twin” strategy expanding nicely to encompass the experience of humans, from the microscopic to the macroscopic, in their built and natural environments, as highlighted in Figure 1. The future looked bright for the combination going into 2020 and then the COVID-19 pandemic gripped the world. While many industries are suffering, healthcare and specifically field trials of drugs, treatments, and equipment are ramping up exponentially in response to the crisis. Mr. Charlès stated that about 60% of worldwide COVID-19 trials were being managed on the Medidata platform. Dassault Systèmes is well positioned to have a seat at the table helping to define this new Industry Renaissance.

Figure 1--Expanding the Vision to the Virtual Twin Experience of Humans (Courtesy of Dassault Systèmes)

Medidata’s solutions are delivered on the cloud and Dassault Systèmes has made strategic investments there too. Their 2017 acquisition of Outscale brought a provider of enterprise-class cloud computing infrastructure in-house. Dassault Systèmes uses Outscale and other cloud services (e.g., Amazon Web services (AWS)) to deliver its cloud-based 3DEXPERIENCE platform and portfolio of industry solution experiences. The cloud, according to Mr. Charlès, is a central element in their strategy to best support their customers’ mix of on-premise and cloud-based offerings. The cloud will certainly be important for delivering value going forward but does a software company need to own its cloud infrastructure? Others have bet big on infrastructure-as-a-service (IaaS), so it is not clear what this small bet really means, other than supporting a deep understanding of delivering IaaS in-house.

Mr. Pascal Daloz, Dassault Systèmes’ COO and CFO provided the financial context for Dassault Systèmes recent moves and future plans. Why did they spend so much money in the life sciences sector? Mr. Daloz claimed that the competitive landscape is fragmented in that space and offers an opportunity to actively defragment it and differentiate themselves. According to data from Oxford Economics used often in the presentations, life sciences and health only accounts for 10% of global GDP but is slated to grow 5% vs. 4% for manufacturing. Why will it grow faster? Look around, people are getting older. Many companies are betting on the demographics that this segment will grow significantly. According to Dassault Systèmes, healthcare needs its own Industrial Renaissance and they have invested to capitalize on it. Again, a long bet.

When Dassault Systèmes first went into life sciences, it was one of a set of industries that the company saw as diversification. Those industries now account for 34% of company revenues, up from 27% in 2014. In 2019, Dassault Systèmes received 29% of its revenue just from transportation and mobility, according to Mr. Daloz. Industrial Equipment and Aerospace & Defense are at 16% and 14% respectively. But in 2020 the diversification industries number will jump to close to 50% with Medidata’s revenue included. In addition, Mr. Daloz noted, the life sciences industry spends a lot on innovation, and the industry is relatively inefficient when compared with innovation in other industries. They need a different way to innovate, which Mr. Daloz described as virtual experimentation. Dassault Systèmes will combine the rafts of data gathered in Medidata-managed trials and mix that with the virtual experimentation supported in their multiscale simulation portfolio. The life sciences market is fragmented, with enterprise software competitors and niche solution providers doing their pieces of the digital thread. What this area really needs, according to Mr. Daloz, is a scientific platform to help make it happen: the 3DEXPERIENCE platform.

Of course, this diversification came at a cost. The company had to borrow significantly for the first time, but Mr. Daloz is committed to reduce their debt ratio from 2.5 to 1.5 by 2022. They also expect Medidata revenues to double by 2023, a large contribution toward their 5-year plan to double earnings per share (EPS). One thing the company is not planning is any staff reductions. They developed some savings plans early in the crisis but they want to preserve and even strategically grow their workforce in 2020 to be ready when the market comes back. In fact, Dassault Systemes will still be looking at possible acquisitions. Since M&A is often a contact sport, CIMdata believes it will be harder to get good valuations in a time of six-foot (or 2 meter) distancing and economic uncertainty. It could also help motivate sellers who do not want to ride out the pandemic.

Ms. Florence Verzelen, EVP Industry, Marketing, and Global Affairs has a large portfolio of responsibilities and her two presentations offered some context for the two-day event. Ms. Verzelen emphasized the three economic sectors in which Dassault Systèmes primarily competes: the manufacturing industries (about 20% of global GDP and a 4% CAGR), infrastructure and cities (48% and a 3% CAGR), and healthcare and life sciences (10% and a 5% CAGR). Not surprisingly, her remarks included discussion of the impacts of COVID-19 on the economy and Dassault Systèmes, and how the company is responding. Medidata has a huge role in supporting field trials of new drugs, treatments, and equipment. Beyond just this new acquisition, CIMdata has seen during this pandemic how core Dassault Systèmes offerings, like computational fluid dynamics, have been used to great effect to analyze airborne virus spread. Like many other PLM solution providers, Dassault Systèmes enhanced their cloud offerings to better support working anytime from anywhere, and provided additional access to their learning technology to help people be more productive. Ms. Verzelen also spoke of the importance of ecosystems to delivering their vision in these three industrial sectors. The bulk of their value-added resellers (VARs) are in manufacturing, but they have solid programs in healthcare and infrastructure and cities. CIMdata agrees that an ecosystem approach is essential. There is a lot of content to deliver to many industries and segments, and it is difficult for one company to do it all themselves.

Much of the rest of the two-day agenda focused on updates from Dassault Systèmes’ industry leaders. Their presentations shared the same rough structure: Segments, Strategy, Solutions, and Success Stories. Ms. Claire Biot, VP, Life Sciences, highlighted their strong global position in life sciences: over 8,000 active customers, including all of the top 20 biopharma and medical technology leaders and the top ten clinical research organizations. Over 50% of all clinical trials are supported by their solutions, with over 20,000 in all. Ms. Biot echoed Mr. Daloz’s characterization of Dassault Systems as a science company, a notion that CIMdata agrees with wholeheartedly. According to Ms. Biot, their goal is to “provide life sciences companies and professionals with a scientific and business platform to imagine sustainable innovation capable of improving patient and physicians experience in the age of precision medicine.” Now that they support in-laboratory development, as well as bringing products to the field, CIMdata thinks that Dassault Systèmes might have the technology to deliver the needed platform.

Mr. Thomas Grand, VP, Energy & Materials – Infrastructure & Cities, provided some color on how his segment might fare in a post-COVID-19 environment. Natural resources normally face headwinds in an economic downturn but an oil price war was raging before COVID. In fact, based on the logos displayed to signify wins, the company did quite well in this sector in 2019. One bright spot in this sector is Dassault Systèmes’ work in the area of maintenance, repair, and overhaul, a key capability in a product-as-a-service (PaaS) future. In fact, Mr. Grand spoke about the 3DEXPERIENCE platform as a model-based vendor/operator hub, a new way to support complex MRO in facilities. The platform integrates with commercial enterprise asset management solutions to leverage local information resources. PaaS is the future in many of Dassault Systèmes’ core industries so this is a crucial investment that can be leveraged in many industries in which they compete.

Ms. Laurence Montanari, VP, Transportation & Mobility – Manufacturing, recently joined Dassault Systèmes from Renault. The automotive industry was undergoing great change before COVID. Now personal transportation may need to be rethought again. Ms. Montanari had the pleasure of discussing a signature win for Dassault Systèmes at Toyota, an implementation for 40K users by 2023, with 20K online now. Their Power’By strategy for the 3DEXPERIENCE platform gives Toyota the MCAD data management flexibility to support a single source of truth across R&D, design, production, customer service, alliance companies, and suppliers. Ms. Montanari also echoed the importance of the cloud in delivering their solutions to transportation and mobility customers. Cracking into Toyota is a big win for the company, but Dassault Systèmes will be more challenged getting the automotive sector as a whole to the cloud. While CIMdata believes that security in a cloud-based environment can be better than on-premise, the auto industry looks to be a laggard because of their long history of strict IP protection and sizable homegrown IT investments.

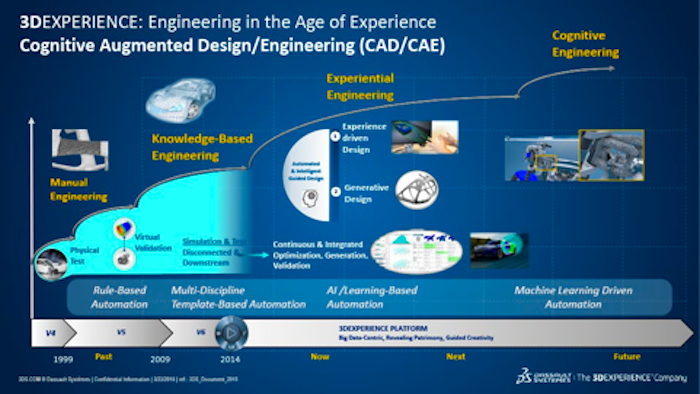

Mr. Philippe Laufer, the former CEO of CATIA now has the title EVP, 3DS Global Brands, the designated Dassault Systèmes brand champion. He spoke about the brand promise for the 13 Dassault Systèmes brands, claiming over 25 million users strong. CIMdata hopes that these promises are right because Mr. Laufer stated that each brand has a double-digit growth target to hit. Mr. Laufer also proposed how engineering will evolve in the age of experience to cognitive augmented design/engineering (CAD/CAE), repurposing the common acronyms as show in Figure 2. He claimed that customers are tired of having designers and simulation specialists work in silos and want a platform to bring them together. Mr. Laufer believes thisapproach, powered by the 3DEXPERIENCE platform could reduce development time by a factor of ten. We look forward to seeing the case studies proving this old claim.

Figure 2—Cognitive Engineering (Courtesy of Dassault Systèmes)

Mr. Tarek Sherif, the Co-CEO & Co-Founder, Medidata, has also picked up some new titles at Dassault Systèmes: The Chairman of Life Sciences and Healthcare Board. As with all of their industries, Dassault Systèmes represents the lifecycle as a spiral. In this case, the spiral starts at “discover, research and design,” which is appropriate for molecular therapy or medical device development. These new products are proven through clinical trials and ultimately need to be manufactured and commercialized. According to Mr. Sherif, Medidata focuses on clinical trials and commercialization. He provided more specifics on how Medidata works with leaders: 18 of top 25 pharma, 10 of 10 Contract Research Organizations, 13 of 15 top-selling drugs are “powered by Medidata.” As important, Medidata has 45 billion clinical data points and processes 450 million images each year. “Data is the new oil,” as some say, and Medidata provides a rich pool of data that can be leveraged for knowledge-based applications. Mr. Sherif echoed the earlier messages about inefficiency, backed by more data: only 9.6% of drugs move from phase I to approval, often taking more than 10 years, with very unpredictable schedules. Companies spend an average of $2.6 billion per drug. But, Mr. Sherif claimed, trials today run much the way they did 30 to 40 years ago. Medidata is trying to help the industry adapt. For example, in this socially distanced world, virtual drug trials that use subjects where they are, not in a clinic, are more desirable and Medidata is working to improve the patient experience. Their first release of myMedidata, their Web-based patient engagement platform, is a COVID-19 Symptom Tracker application that patients can access from their own devices to contribute to on-going COVID-19 research. Medidata was a good investment before COVID-19. It will be even more successful in a world of heightened experimentation in healthcare.

Of course, Dassault Systèmes continues to heavily invest in their core industries. Mr. David Ziegler, VP, Aerospace & Defense – Manufacturing, hypothesized how COVID-19 will impact their A&D segments. Commercial aviation, airlines, and airports will be heavily impacted, while the defense side of the business will see less impact. The company now has long-term strategic agreements in place with Boeing, Airbus, and Lockheed Martin to help co-develop Dassault Systèmes evolving solutions. Mr. Ziegler claimed that about 30% of their installed base is on the 3DEXPERIENCE platform, which is essential as their product innovation is delivered via the platform. Mr. Philippe Bartissol, VP, Industrial Equipment – Manufacturing, cited another Power’By win in his industry, a company with over 2,500 PLM users and 1000+ MCAD users adopting three Industry Solution Experiences (Single Source for Speed, Concurrent Equipment Engineering, and Ready to Make) to support their move from an engineer to order (ETO) to a configure to order (CTO) business model. Go live is expected later this year, with a roadmap including DELMIA and MES with Apriso in planning. Mr. Bartissol also highlighted work in their line-builder initiative, also focused on advanced configuration management to support the line-builder quotation process. This is an important capability for Dassault Systèmes to advance as it will be essential to support mass customization responses to Industry 4.0 requirements.

In conclusion, Dassault Systèmes’ first virtual analyst event was a rousing success. The two four-hour sessions were a bit long, but the content was strong, with some very important updates on aspects of their business. Investment continues in their traditional industries, with some good wins across multiple segments, and strong movement to their new solutions increasingly delivered on the cloud. But significantly more growth is expected for their life sciences business, driven by the recent addition of Medidata. Dassault Systèmes is in the right place at the right time for that segment overall, but the COVID-19 pandemic has made their emphasis here even more timely. The challenge will be to balance investment in both sides of their business to sustain growth while keeping each constituency happy. With strengths in both parts of their business this is a good problem to have and continued success will help bring things to life for many years to come.