Key takeaways:

- Dassault Systèmes returned to an in-person analyst event on 22-23 June 2022, with nearly 30 analysts from around the globe in attendance in Velizy, France or online.

- The sessions emphasized Dassault Systèmes’ Industry Solution Experiences, an expansive platform-enabled solution offering that spans the product lifecycle embedding applications and technology from their numerous brand portfolios.

- While Dassault Systèmes’ long-term focus has been in Manufacturing, they look to Life Sciences and Infrastructure & Cities as engines for stronger growth moving forward.

- Dassault Systèmes reported 11% overall growth for 2021. Medidata has been a major contributor to their success over the last two years, particularly in the cloud.

CIMdata was pleased to attend the 3DS Industry Analyst Days, hybrid session convened by Dassault Systèmes on 22-23 June 2022. Many attendees from the global firms represented attended in person with others joining remotely. The ambitious agenda packed a lot of content into the 1.5-day event.[1]

Mr. Bernard Charlès, Vice Chairman of the Board & Chief Executive Officer for Dassault Systèmes (DS), welcomed the crowd in a short video. Dassault Systèmes has talked about the importance of experience for a decade, and Mr. Charlès emphasized the need for industries to move to an experience economy, where product use has more value than the product itself (e.g., product-as-a-service business strategies and opportunities for in-use purchases). At the same time, he emphasized that industry needs to move from a linear to a circular economy, with this vital topic central to Dassault Systèmes’ three target sectors―Manufacturing, Life Sciences & Healthcare, and Infrastructures & Cities―and the twelve industries they address within those sectors. CIMdata has championed the Circular Economy concept since 2014 and is heartened to see a PLM market leader embrace the concept so strongly.

Next up was Mr. Pascal Daloz, Chief Operating Officer and Member of the Board, who was joined by Mr. Hubert Masson, R&D 3DEXPERIENCE Platform User Experience (UX) Senior Director. The company sees their platform, shortened in this commentary to 3DX, as central to their strategy in all sectors, not just their Manufacturing roots. Of course, this requires an expansive view of the term “platform” as not all of their solution is part of the same code base. But that is changing, according to Mr. Daloz, with their Medidata acquisition being quickly brought into the fold through integration. Medidata, a global leader in clinical trial management, was acquired by DS in June 2019, optimal timing for a world obsessed with clinical trials to help abate the COVID-19 global pandemic. This acquisition has been a major engine of DS’ growth over the last two years, particularly in the cloud, where Mr. Daloz claimed DS received 20% of their software revenues in 2021, going to a third by 2025. Much of this cloud revenue will come from Medidata, which told Wall Street their revenues would grow at 16% year on year, with 85% of that being subscription, when they were acquired. And this was in late 2019 right before the pandemic. In a later session, Mr. Rouven Bergmann, Executive Vice President and Chief Financial Officer, claimed that 80% of their software revenue is recurring. This is impressive and important for revenue stability, which also pleases investors. Dassault Systèmes does not often take advantage of the investment community for funds, powering their own growth and funding mergers and acquisitions (M&A) with their internal funds. But access to capital has always been important to them and may be needed to fund their future M&A activities in their growth sectors. Their 2040 vision is even more ambitious, hoping to grow the company into three equivalent “companies” across their three sectors.

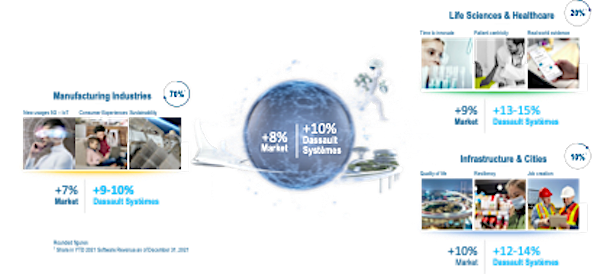

While the company’s legacy is in Manufacturing, the company sees opportunities for a higher growth rate in their two other sectors, Life Sciences & Healthcare and Infrastructure & Cities. The company’s perspectives on revenue growth are shown in Figure 1. This makes a lot of sense. They are competing tooth and nail in Manufacturing with their long-time foes Siemens Digital Industries Software and PTC, while also fending off rapidly growing firms like Aras. In contrast, the other two sectors have no dominant players and Infrastructure & Cities has a lot of point solutions that cry out for the collaboration, data management, and integration capabilities of the 3DX platform.

Figure 1―Revenue Growth Perspective

Courtesy of Dassault Systèmes)

As stated in the introduction, this was an ambitious agenda for the time allotted. Some presentations were a bit rushed but it was good to get an update on the breadth of what DS has to offer. Overall, DS continues to build out their Industry Solution Experiences (ISE), industry-focused offerings that span the product lifecycle. The company licenses role-focused capabilities within each ISE, designed to bring the needed support for users in a particular role. Based on the progress discussed, it appears that DS continues to offer more of their ISE capabilities on the cloud than on-premises. (This is a common strategy for software companies, i.e., putting the new and “cool” stuff where the company wants their customers to move, in this case the cloud.)[2] DS also has a unique strategy as the only leading PLM solution provider to offer their solutions on cloud infrastructure they own (from their Outscale investment in 2017). With each release the company is improving the overall UX and bringing more of their vast brand resources to bear in their ISEs. The progress they have made is impressive but some of our industrial clients have suggested that many of the roles within the ISEs are not as deep as they had hoped. We and our industrial customers regularly provide that feedback to DS to help the offerings more effectively evolve.

DS also sees their brands (e.g., CATIA, ENOVIA, BIOVIA, and SIMULIA) as central to market success, working towards making each brand a “love mark,” a concept from business-to-consumer marketing that suggests the brand affection and loyalty of their customers. In a brand-focused session, Mr. Philippe Laufer, Executive Vice President, 3DS Global Brands, stated that the company now had 30 million users of their many offerings, up 20% over 2020. He claimed that 8 of the 12 DS brands were leaders in their domains. CIMdata agrees that DS does have many leading and strong brands, but perhaps not quite that many. These brands help power “irresistible user experiences” according to Mr. Laufer, delivering specialized expertise across 30 domains and 81 disciplines delivered in 470 Cloud roles.

Additional highlights from the event follow.

Dassault Systèmes progress on one particular topic was impressive and much needed: the ability to support lifecycle assessment (LCA) within the 3DX platform. LCA is defined as the systematic analysis of the potential environmental impacts of products or services during their entire life cycle. The theme of CIMdata’s 2022 PLM Market & Industry Forum series was Sustainability and LCA is an important tool to help industrial organizations meet their sustainability objectives. Ms. Florence Verzelen, EVP, Industry, Marketing & Sustainability, described six Industry Process Experiences (ISPs), components of ISEs, related to LCA:

- Sustainability Driven Design

- Sustainability Driven Engineering

- Sustainable Design Orchestration

- Weight & Sustainability Driven Engineering

- Product Innovation

- Packaging Innovation

This is a vital capability, and the demonstration was impressive. Only 22% of the industrial respondents to CIMdata’s recent sustainability survey were calculating the carbon footprint of their production, with lower percentages for other contributors (product use, their supply chain, logistics support, etc.).[3] LCA is a vital tool to be used across the value chain to help bring these percentages to where they need to be.

One phrase that has gained a lot of attention in the last several years is digital twin, which CIMdata defines as a virtual representation (i.e., digital surrogate) of a physical asset or collection of physical assets (i.e., physical twin) that exploits data flow to/from the associated physical assets. DS prefers to use the phrase “virtual twin” to describe much the same concept, with virtual twins being central to experience, a concept that has been key to the company since 2012. Over the last several years, CIMdata has executed multiple industrial surveys about adoption and use of digital twins, with interest and adoption growing each year. But in practice, they can be complex to develop and even more difficult to synch with physical products as they evolve over the lifecycle. To help industrial companies, DS is developing outcome-based virtual twin delivery models that can be delivered as managed services as described by Mr. Michel Tellier, Vice President of Outcome Based Engagement. It is early days but this approach bears watching as Mr. Tellier and his DS team flesh out the concept and can report on the outcomes achieved by their early adopters.

Medidata is not the only acquisition that has thrived as part of DS. In 2018, DS announced they had acquired a majority stake in Centric Software, a fast-growing company in retail footwear and apparel (RFA), an industrial segment that over the last several years has invested heavily in PLM. At the time of the investment, Centric Software claimed to support over 600-globally recognized brands. Today they support over 5,000 brands at over 600 customers, claimed Mr. Philippe Loeb, VP Home & Lifestyle and CPG-Retail. As his title suggests, they have expanded beyond just RFA into Home & Lifestyle and in 2021 expanded their offerings by acquiring Armonica, a cloud-native retail planning solution. In addition, they are planning a move into formulated products, leveraging technology from Enginuity, a 2011 acquisition, and Quintiq, acquired in 2014. Centric Software is another example of a great acquisition by DS.

While Medidata has been an engine for growth, only a small part of their revenues, about 5% come from patient care, an area targeted for investment and growth, claimed Mr. Sastry Chilukuri, co-CEO, Medidata. CIMdata was impressed by their work growing ecosystems of partners, influencers, and regulatory agencies. As is often the case with DS, they are talking about creating new paradigms in patient care. Working closely with these ecosystems is one way to accelerate change. As a point of comparison, it took the automotive and aerospace regulators many years to accept virtual testing as a replacement for physical testing. Mr. Chilukuri rightfully said that in patient care we cannot wait that long. CIMdata agrees, particularly given the global demographics of aging populations.

Mr. Patrick Johnson, Senior VP Corporate Research & Sciences, delivered a presentation on DS’ approach to advancing the state of the art in the three supported sectors. Within Life Sciences & Healthcare, BIOVIA and Medidata are the core brands but the whole 3DX platform is used extensively within the medical device industry. The plan is to develop virtual twins of patients, hospitals, and healthcare systems. The platform supports all the fundamental sciences; mechanical, electronic, software, biology, chemistry, and perhaps most important, data, all potentially connected through system models that will enable full system of systems optimization. Previous work on the living heart and living brain is being expanded toward oncology, with a focus on a virtual twin of cancer cells and tumors. Medidata’s data and processes are being leveraged for tasks such as automatic lesion identification and virtual trials, which improve the quality of data that comes from trial testing leading to products that improve outcomes faster.

The 3DX platform supports multiple scales starting with RNA modeling of biological reactions and materials scaling through design and manufacture of devices and therapies, into the design and optimization of healthcare systems. This is an audacious scope and DS has made significant progress. CIMdata believes their vision to tie the capabilities together using a system modeling approach will lead to breakthroughs that improve healthcare outcomes for all of us.

Within the Infrastructure & Cities sector, Mr. Johnson noted that DS is focused on supporting circularity and human centricity by using a system of systems approach. Some of the projects he mentioned included battery recycling, and analyzing homes for eldercare support and recommending changes. Another interesting capability discussed was the ability to scan buildings and factories using point clouds to quickly generate models and to leverage AI to recognize features such as equipment within production lines. The equipment could then be rearranged to improve performance. It is important to note that this capability can be applied across both the manufacturing and infrastructure sectors.

Ms. Laurence Montanari, Vice President, Transportation and Mobility Industry, reviewed industry trends for transportation and described how DS was addressing them. Ms. Montanari previously worked at Renault, leading two vehicle programs, including a program that designed an EV to address “last mile” delivery in urban areas. Electrification is a megatrend driving transportation and battery technology is critical for success. Ms. Montanari described how other DS industry capabilities from SIMULIA and BIOVIA are being leveraged to address massive scaling and technical issues such as battery chemistry. In addition to the industry solutions, the LCA horizontal application is being tailored to support transportation and to help alleviate the extreme pressure on the industry from consumers and regulators. She also noted that DS is helping customers address the supply chain issues that have ravaged industries over the past few years by using DELMIA Quintiq. The CIMdata takeaway is that while DS has organized into industry verticals, they are able to leverage the application of specific technologies across industries bringing innovation where it is needed.

Mr. Stéphane Sireau, Vice President, High Tech Industry, is responsible for all aspects of high-tech including electronics design, semiconductors, batteries, connected systems, and digital infrastructure. His remarks focused on the multi-scale approach DS is taking from material science, including leveraging BIOVIA to support chip design and manufacturing, and integration into systems and infrastructure. He described DS’ end-to-end approach to help customers conceptualize, design, efficiently manufacture, and support products. As with transportation, he noted that sustainability is critical, and his team is leveraging the core LCA technology to ensure consistent support for sustainability across industries on the platform. CIMdata was impressed by the systems approach Mr. Sireau articulated as we strongly believe it’s the only way to address the complexity of modern technology and products.

Mr. Philippe Loeb, Vice President, Home & Lifestyle and CPG-Retail industries, provided an overview of his industry purview that includes products ranging from sporting goods to shoes to power tools. Again, the solutions offered by the 3DX platform for design, simulation, and manufacturing are being leveraged to ensure that industry-specific roles have the correct tools to efficiently get their jobs done. He highlighted the HomeByMe product based on 3DVIA technology, which is used to help customers leverage virtual twins to furnish and decorate their homes. Ikea is using this product and is serving up to 100k users per day. DS has long had the vision of 3D everywhere, including in the hands of the general public, and the HomeByMe solution is a huge step in scaling up 3D adoption. Mr. Loeb also discussed how CPG companies, such as Pepsico, are leveraging 3DX platform capabilities such as sustainable package design, virtual testing (based on Medidata technology), adherence to sustainability, and formulation and specification development and materials development using capabilities from BIOVIA to bring new products to market.

As life sciences is one of DS three sectors and is the fastest growing, it’s fitting that the agenda saved the “best for last.” Mr. Tarek Sharif, Medidata Co-founder and Co-CEO, delivered an opening video to set the stage and Ms. Claire Biot, Vice President, Life Sciences & Healthcare Industry, Mr. Sastry Chilukuri, co-CEO, Medidata, and Mr. Reza Sadeghi, Vice President, BIOVIA Strategy, co-presented on how DS is approaching life sciences and healthcare.

Dassault Systèmes’ goal is to transform how therapies get to patients by using biology platforms combined with multi-scale technology and AI to leverage data to bring new therapies to market much more quickly. A critical offering they brought to market based on this approach is “Design to Cure.” Historically, medicine development was focused on small molecule products such as antibodies, Mr. Sadeghi described how DS is focused on supporting the much more complex process of biologics, as well as cell and gene therapies. He also noted the research DS has done on quantum dynamics to help pharmaceutical companies predict how well their therapies will interact or dock with their targets with high precision. This is exciting work that will have a large impact.

Conclusion

Dassault Systèmes has aggressive plans for growth in Infrastructure & Cities and Life Sciences & Healthcare, which they see as offering more growth potential than Manufacturing. CIMdata agrees with this assessment. Both of those sectors are currently supported by point solutions that could benefit from a unifying solution like the 3DEXPERIENCE platform. CIMdata is impressed by their continued work in the Manufacturing sector, and the depth and breadth of their work with influencers, government agencies, and other key actors in their growth sectors, as changing paradigms demands this level of engagement. Their financial goals are aggressive and CIMdata is happy to have a front row seat to monitor their progress.

[1] Travel and/or other expenses related to this commentary were provided by Dassault Systèmes.

[2] Of course, Oracle and SAP have PLM offerings and their own cloud infrastructure but PLM is not the focus of their business.

[3] “Sustainability and PLM,” available with registration: https://www.cimdata.com/en/resources/complimentary-reports-research/white-papers