Key takeaways

- The food & beverage (F&B) industry is facing many challenges affecting the ability to bring new products to market and drive growth and margins, notably inflation, fear of recession, risk of reinstated COVID measures, new regulations, and continuing supply chain disruptions for all materials from raw ingredients to packaging materials.

- Continuing pressure on national brands from competitively priced private brands is driving product innovation, complicated by the emergence of new food categories, and changing consumer preferences. At the same time, opportunities are being created for local brands to gain shelf space at large retailers.

- Processes for developing new F&B products require efficient cross-functional internal and external collaboration, adherence to best-practice workflows and management of critical information.

- Technology enablement and digital transformation represent a significant opportunity for both start up and large F&B companies; local or national or even international. But many companies still run off of spreadsheets―a way of working which has been proven to be inadequate especially in the face of continuously changing compliance, traceability, and sustainability requirements and initiatives.

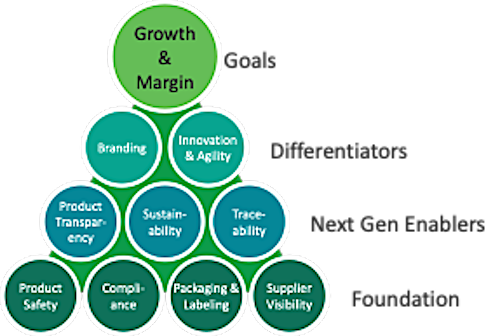

- CIMdata has identified nine critical imperatives that F&B organizations need to address. This model is based on CIMdata’s combined expertise gained from helping many companies in the F&B industry to identify their challenges and how best to respond to them.

- Centric Software® offers a complete and integrated solution allowing F&B brands, retailers, and manufacturers to speed new product introductions, maximize product margins, assure compliance and safety, and increase business agility to stay close to the consumer.

Introduction

Not surprisingly, the food & beverage industry is one of the largest in the world. In the US alone, it is worth over $2 trillion, when measured based on grocery and food service revenues.[1] The market leader is Walmart, where groceries constitute roughly 55% of sales. Roughly 25% of all dollars spent on groceries in the United States are spent at Walmart. Kroger (#2) who, at the time of writing, announced an intention to acquire Albertsons (#4) have roughly 8% and 5% of the U.S. grocery market, respectively. Eyeing the grocery market for further growth, Amazon is estimated to have taken about $4 billion in market share from Kroger and Albertsons in the past two years.[2]

The F&B industry has been riding a roller-coaster since early 2020. First the COVID pandemic impacted supply chains and radically shifted long-standing demand patterns as consumers primarily ate from home during this period. This caused dramatic stock outages from which the industry still has yet to fully recover. But before that problem could be fully addressed the industry faced new challenges in the form of global price inflation with no resolution currently in sight.[3]

As inflation deepens, grocers are pushing back on the national food brands to avoid raising prices and losing customers. For example, in Germany ALDI and Lidl want price guarantees from their brand manufacturers. The brands are unwilling to provide these so, for now, brands such as Danone, Nestlé, and Henkel are not on sale in these stores.[4] Also, in February 2022, Canadian Giant, Loblaws pulled Frito-Lay products from shelves following a pricing dispute.[5]

However national brands are only part of the story. In Germany, customers are increasingly using Lidl’s and ALDI’s private brands, which are much cheaper but typically offer the same quality. Roughly 90% of the items in ALDI’s stores globally are private brands. In the US, Trader Joe’s has a private brand share of spend at 59%, followed by Wegmans Food Markets at 49%.[6]

In the US, private brand sales hit $199 billion in 2021. New research indicates that over 80% of food retailers and manufacturers expect to increase investment in private brands over the next two years, with the current average dollar share of 18.2% rising to 22.6%. Retailers believe they can achieve this by means of new product innovation (e.g. premium, simple ingredients, price/value, and meal solutions), supplier price negotiations, and boosting eCommerce.[7]

Perhaps most urgent, however, is addressing the food contamination that continues to plague the industry. In the US, the Centers for Disease Control and Prevention (CDC) estimates that every year 48 million people get sick, 128,000 are hospitalized, and 3,000 die from foodborne diseases.[8] To address this, in 2011 the Food Safety Modernization Act (FSMA) was signed into law with the goal of transforming the US’s food safety system. However, as FSMA has been rolled out, the number of outbreaks has grown steadily from 795 per year to over 1,000 in 2018.[9]

Closely aligned with contamination is the impact of allergens, which also lead to a significant number of deaths every year. This can be due to poor control over manufacturing processes, inadequate labeling, or both. In the UK, the recently enacted “Natasha's Law” requires full ingredient and allergen labeling on all food made on premises and pre-packed for direct sale. The change follows the death of Natasha Ednan-Laperouse from anaphylaxis after she ate sesame in a baguette which she purchased at Pret a Manger.[10]

Innovation is a constant need in the industry as brands jostle for market position. Unfortunately, much of the innovation is just simple brand extensions, new cereal flavors for example, which merely cannibalize existing product sales. But real innovation is happening in some areas, for example, meal solutions and desserts. Often, private brands beat national brands to market with product innovations. The need to heavily promote new offerings and the associated costs make the national brands hesitant to launch new products. But perhaps the most interesting innovation is coming from niche brands and local suppliers. For example, locally made BBQ sauce, salad dressing, spices, honey, jam, etc. Grocery retailers are increasingly looking to smaller suppliers to create new products that can be brought to their shelves quickly and easily.

Bringing new products to market is never easy, involving complex processes requiring cross-functional internal and external collaboration. Other problems lie under the surface, all requiring a degree of urgency to fix. These include addressing consumer demands for ingredient transparency, ensuring sustainable harvesting of ingredients, moving to recyclable packaging, ensuring compliance with evolving regulations, and implementing methods to improve traceability.

In most industries, Product Lifecycle Management (PLM) solutions are being used to manage the development of new products and bring them to market quickly and efficiently. Unfortunately, F&B has been late to adopt PLM. Even with the numerous challenges outlined above, the use of comprehensive PLM solutions is generally low and, in some cases, actively resisted. While the largest organizations in F&B are using PLM for key functions such as specification and formula management, supplier management, packaging, and artwork development, many smaller organizations persist with simple solutions based on spreadsheets and email. This makes information hard to share in support of what is essentially a collaborative process, leading to avoidable delays and errors, and limiting process improvement initiatives.

A key symptom of the confusion that arises in this environment is the development of labeling―a true “canary in the coalmine” moment. Uniquely, the product label brings together most of the functions in the product development process―branding, quality, food science, regulatory, marketing, and others. Any miscommunication of information during the development process will often not be seen until this late stage. Further confusion often arises during attempts to resolve errors, resulting in many revisions being required before a label is finally approved.

Fortunately, the F&B industry is well-supported with several competing PLM solutions available. For example, Centric Software offers a comprehensive and integrated solution allowing F&B manufacturers to speed new product introductions, optimize product portfolios, and ensure compliance and safety while maximizing product margins.

The Critical Business Imperatives and How To Address Them

To guide F&B companies at all stages in the product value chain in the use of PLM, CIMdata has identified nine critical imperatives. These are based on CIMdata’s combined expertise gained from helping many companies in the F&B industry to identify their critical challenges and appropriately respond to them. This includes brand companies operating globally, those based in North America and Europe, ingredient manufacturers, national and local grocery retailers, contract manufacturers, and ingredient processors.

Figure 1―Critical Imperatives for Food & Beverage Companies

Foundation

There are four imperatives at the Foundation level: Product Safety, Compliance, Packaging & Labeling, and Supplier Visibility. These can be thought of as “table-stakes” capabilities that all F&B organizations need to possess. Best-in-class organizations are already using PLM to address these imperatives and ensure they can execute efficiently and effectively. In many cases, PLM is already differentiating some companies from their competitors due to superior and mature capabilities to develop, launch, and maintain products. However, many in the industry have still to implement a comprehensive PLM solution leaving them at a competitive disadvantage with considerable scope for performance improvement. In the absence of a PLM solution, companies rely on spreadsheets, emails, and other personal productivity solutions making accurately sharing, tracking, and updating information extremely difficult, if not impossible. Errors are common.

Next Generation Enablers

There are three imperatives at the Next Generation Enablers level of the model: Product Transparency, Sustainability, and Traceability. These are capabilities that in a few years’ time will distinguish the leading players from the rest. Today, even best-in-class organizations are still working to build a complete response to these imperatives with none having yet achieved full completion. However, all understand that the use of a PLM solution will be essential to achieving their goals, building on capabilities already deployed in addressing the Foundation imperatives.

Differentiators

The final two imperatives are at the Differentiators level of the model: Branding, and Innovation & Agility, where there is always pressure to improve and the bar is always being raised. Best-in-class organizations set the standard for others to match―many are far behind. Again, PLM is a critical enabler for addressing these, putting those that have already implemented PLM solutions at an advantage.

The Imperatives

Individual imperatives are summarized below, and all will be familiar to those in the industry. It is important to realize that these do not exist in isolation, they in fact overlap and impact one another. However each has a distinct focus, often mapping to a specific area of the organization, which can simplify ownership and actions.

Foundation

Product Safety―Know what’s in your products through specification and recipe management, and where and how they’re being made by maintaining adequate supplier records. Ensure accurate labeling, and be ready to act when a problem occurs. Labeling is one of the most complex and critical to manage, and involves many of the other imperatives, e.g., Compliance, Packaging & Labeling, Supplier Visibility. PLM solutions provide all of the fundamental capabilities to allow F&B organizations to achieve Product Safety.

Compliance―Document and adhere to best practices embodying both brand and regulatory requirements. Gather data to ensure compliance, and leverage it across the organization. PLM solutions are designed to guide users through pre-defined workflows ensuring best practices are followed and required data is gathered and shared in a standardized manner.

Packaging & Labeling―Design packaging to ensure contents are adequately protected and that sustainable and safe materials and processes are used. More than just artwork, labeling is often the most error prone aspect of product development as branding, creative, legal, quality, safety, and regulatory come together to agree what goes on the packaging. PLM helps to ensure that the information required for labeling is accurate, reducing errors and the need for multiple artwork revisions. PLM can also help with packaging design, material selections, and communication with manufacturers.

Supplier Visibility―Employ a “trust and verify” approach to working with suppliers. Work closely with them to ensure they meet or exceed your expectations in all areas. PLM can help by gathering and maintaining critical supplier information, as well as managing certifications, inspections, audits, and non-conformances.

Next Generation Enablers

Product Transparency―Let your customers know about the food they’re buying―what’s in it, where it came from, how it was harvested, etc. PLM can be used to help manage critical ingredient information in collaboration with suppliers. Product Transparency is a critical element in ensuring that allergens are identified and properly declared. It also plays a role in supporting marketing claims such as “vegan,” “healthy,” Kosher, “zero sugar,” and to respond to changing consumer tastes and behaviors (ex: palm oil free, OGM free), etc.

Sustainability―Address consumer concerns about waste by implementing improved business practices to make sustainable ingredients, packaging, and working practices the new normal. PLM can help by maintaining accurate information about materials, ingredients, harvesting, and processing, thereby allowing organizations to calculate and manage the environmental footprint of their products.

Traceability―Regulations don’t always demand full traceability of ingredients, but savvy brand owners want to understand every level of their food supply chain and monitor it for safety, compliance, and sustainability. PLM is an essential enabler for Traceability, ensuring customer loyalty by allowing manufacturers to gather and manage required information from their suppliers.

Differentiators

Branding―More than just the packaging, Branding is the culmination of all capabilities. Having great products is the starting point but establishing and maintaining brand standards for ingredients, claims, and packaging is the new battle ground. By managing every aspect of product development, PLM solutions can ensure that brand standards are rigorously met at every step in the process.

Innovation & Agility―Best-in-class F&B organizations react quickly to emerging consumer needs and competitor activity to develop and launch new sub-brands and products at scale. By ensuring best practices are followed and enabling internal and external collaboration, PLM solutions can help companies quickly respond.

Centric PLM for Food & Beverage Brand Owners and Manufacturers

To help F&B organizations meet their goals, Centric Software has developed Centric PLM®―a flexible, modular, and user-friendly solution, packed with market-driven innovations that optimize product development and launch―from concept to shelf. It provides a real-time ‘single source of the truth’ for product-related data and manages products, people, and processes across the entire product lifecycle.

Integrated workflow management means that flexible workflows can be built to lead cross-functional teams through various processes, with automatic task hand-offs. Project management features provide users with an advanced planning tool, collaboration functionalities, and dedicated monitoring dashboards to optimize NPD execution.

Centric PLM allows organizations to gain full visibility, track and implement compliance changes, and streamline checks with built-in process management. The solution can also connect to a regulatory database to support compliance assessment during recipe development.

An embedded formulation tool allows users to efficiently build recipes (leveraging customer material database or connected food databases such as USDA SR legacy, USDA FNDDS, USDA Branded Foods, CIQUAL), automate real time calculations (nutrition, allergens, cost, ingredient breakdown and statements, …) and assess recipe compliance.

Users can connect Adobe® Illustrator and leading 3D CAD solutions like SOLIDWORKS and Rhino directly to Centric PLM for seamless packaging design. Users can connect packaging briefs to product briefs and develop packaging using templates populated with formulation, allergen, nutrition, and regulatory data from PLM.

Centric PLM is set up for end-to-end traceability. All records are connected to the product, from initial concept to product brief creation to sourcing, supplier responses, lab test results, compliance documents, packaging, final product approval and placement in assortment, and merchandise plans.

Centric PLM integrates easily with enterprise solutions such as ERP, PIM, DAM, e-commerce, demand planning, leading 2D and 3D CAD design platforms, and more for streamlined end-to-end data management and collaboration.

F&B Companies already benefitting from Centric PLM include Ferrero, Aviko, Milarex, Montenegro, Great Kitchens, Starpro, Wicked Kitchen, Prodiet, Qinhai, SNS, and more.

Centric Software Background

Centric Software provides innovative enterprise solutions that are used to plan, design, develop, source, and sell products to achieve strategic and operational digital transformation goals.

Partnering with thousands of brands, retailers, and manufacturers across 40+ countries and combining Silicon Valley innovations with market-driven best practices, Centric Software has successfully expanded across multiple industries. Boasting a 99% customer retention rate, Centric is bringing PLM innovations and its proven speed, ease-of-use, and Agile DeploymentSM methodology to the food and beverage industry.

Conclusions

The F&B industry is facing numerous challenges affecting the ability to bring new products to market and drive growth and margins―notably inflation, fear of recession, risk of reinstated COVID measures, and continuing supply chain disruptions for all materials from raw ingredients to packaging materials. Additionally, continuing pressure on national brands from competitively priced private and local brands is driving product innovation, complicated by the emergence of new food categories and alternative consumer preferences.

Processes for developing new products require cross-functional internal and external collaboration, requirements that other industries have found can be met by PLM solutions. However, outside of the largest organizations in the F&B industry there is low usage of PLM, resulting in a number of issues that are not easily addressed by manual ways of working.

CIMdata has identified nine critical imperatives that F&B organizations need to address. This model is based on CIMdata’s combined expertise gained from helping many companies in the F&B industry to identify their critical challenges and respond to them.

Centric Software offers a complete and integrated solution allowing F&B brands, retailers and manufacturers to speed new product introductions, maximize product margins, assure compliance and safety, and increase business agility to stay close to the consumer.

[1] https://www.ers.usda.gov/topics/food-markets-prices/food-service-industry/market-segments/

[2] https:/www.reuters.com/markets/deals/kroger-talks-merge-with-rival-grocer-albertsons-bloomberg-news-2022-10-13/

[3] Research for this commentary was partially supported by Centric Software.

[4] https://www-discountretailconsulting-com.cdn.ampproject.org/c/s/www.discountretailconsulting.com/amp/germany-stores-look-empty-edeka-rewe-aldi-and-lidl-throw-a-brands-from-shelves

[5] https:/www.bnnbloomberg.ca/loblaw-frito-lay-resolve-pricing-dispute-that-pulled-chips-from-shelves-1.1750714

[6] https://www.supermarketnews.com/private-label/aldi-leads-private-label-volume-growth

[7] https:/www.supermarketnews.com/private-label/3-ways-retailers-can-drive-private-brand-growth

[8] https:/www.cdc.gov/foodborneburden/estimates-overview

[9] https://www.statista.com/statistics/618491/foodborne-disease-outbreaks-in-the-us/

[10] https:/www.bbc.com/news/uk-58756597